-

Digital Signage

Digital Signage

for your restaurantDigital Signage

for your storeDigital Signage

for your officeDigital Signage

for your businessWe create simple, turn-key solutionsAsk for an evaluation

for your screens and menu boards.

Since 2005 our experts have been supplying our clients with digital signage that provides an effective way to communicate by anaylzing their audience, goals, location and budget. Our continual support makes sure that their networks keep running smoothly and provide a positive return on investment.

Our services go far beyond screen installations. Mirada's expertise in content design, planning and our efficient network support services, provide an integrated digital signage solution that optimizes your returns and maximizes the effectiveness of your communications.

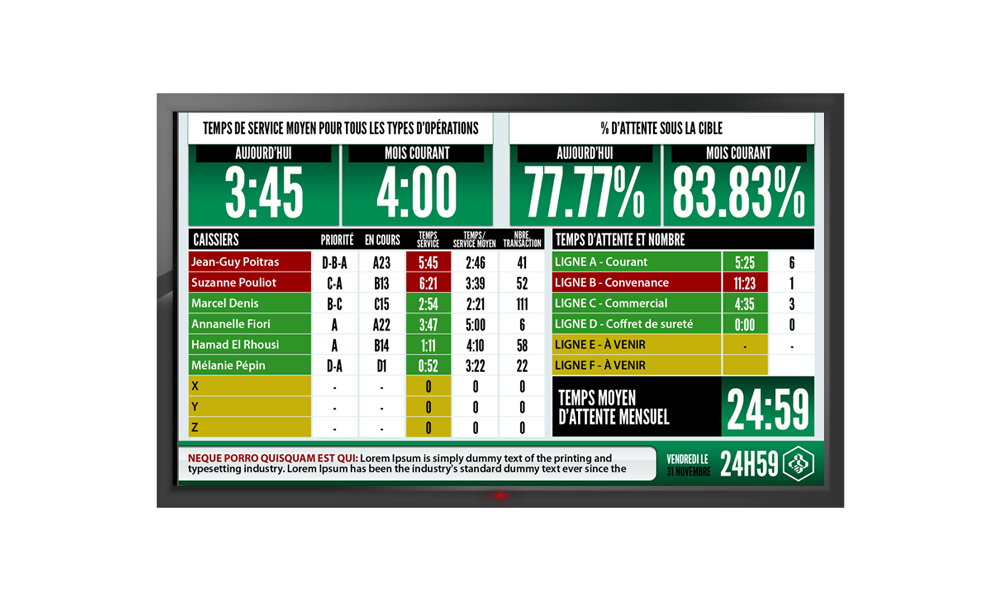

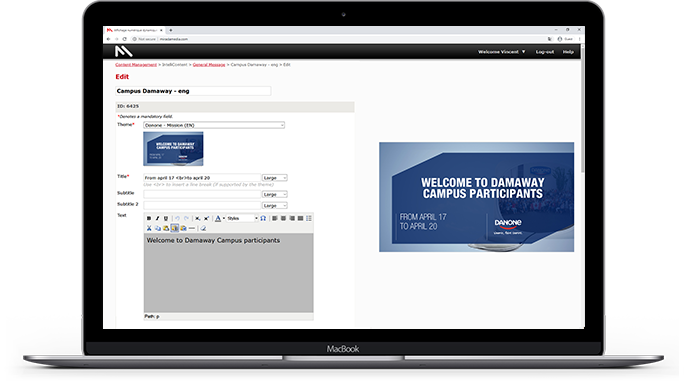

Our web-based platform allows you to control multiple screens at various locations from the comfort of your browser. Schedule images, videos, template-based slides, tickers and layouts with minimal training.

Disseminate pertinent information to your employees, visitors and clients using dynamic displays and get rid of that tired bulletin board.

Corporate, Government, Education, Public Spaces, Transportation, Hospitality

Use dynamic menus to switch items on day-parts, manage prices across locations and influence your clients' purchase decisions to get a higher margin per transaction.

Restaurants, Retail, Cinemas

Use eye-catching displays for your in-store ads to promote new items and sales or sell advertising space.

Retail, Restaurants, Banking, Hospitality, Shopping Centers

Special use applications like directories or room booking schedules mixed with messaging direct your visitors and keep them informed.

Corporate, Real Estate, Sports Centers

With years of experience in digital signage, we analyze your needs, goals, location and your audience's behaviour and dwell time, to develop the content that has the right size, contrast, text and layout for you to communicate effectively.

Learn more about our design servicesThe unusual aspect ratio on LG's new DualUp Monitor could make for an interesting alternative to 16:9 for digital menu boards....

We recently completed a 7-screen digital menu board installation for the Université de Sherbrooke...